Bankruptcy applications

Because restoring financial balance requires conscious legal management, «Arab Charter» provides bankruptcy applications services in accordance with the Saudi bankruptcy system and its executive regulations, to enable individuals and establishments to choose the most appropriate procedure between preventive settlement, financial reorganization, or liquidation. We accompany the client from the initial evaluation until the decision is issued, with precise, systematic steps that preserve rights and restore stability.

Service details

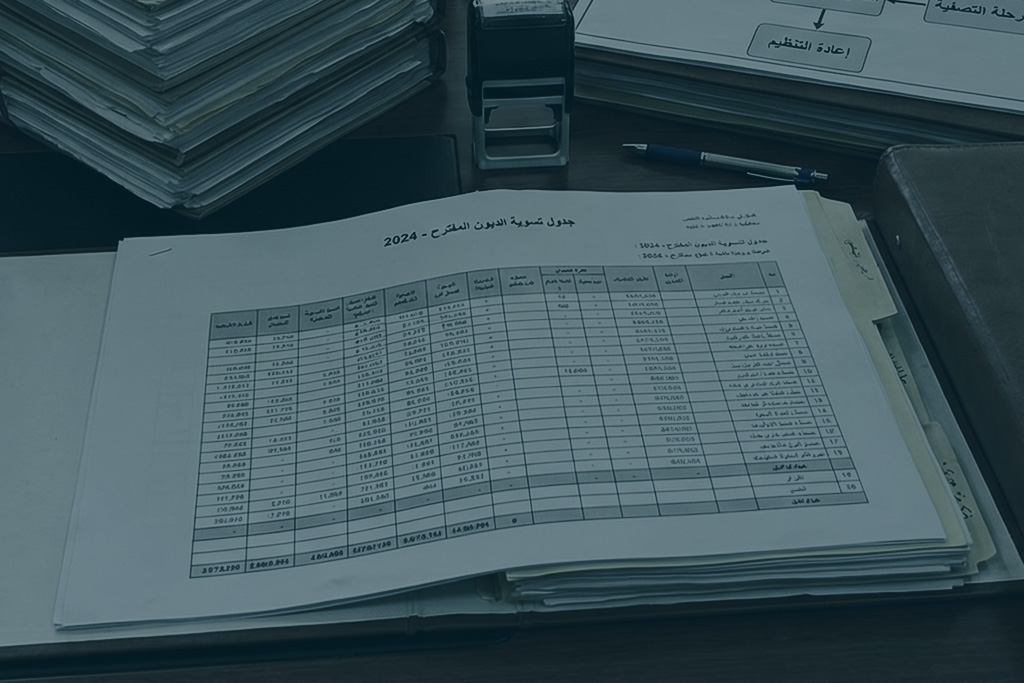

«Arab Charter» Bankruptcy applications are processed using an integrated legal and financial methodology that begins with studying the financial situation and analyzing the client’s credit status to determine the most appropriate path between preventive settlement, financial reorganization, or liquidation. We prepare a legal and financial report detailing the reasons for the default and the extent of the debt. We then submit applications electronically via the Bankruptcy Committee platform, following up on notices and correspondence with authorized bankruptcy trustees.

Our team prepares all required regulatory memoranda during the proceedings and represents the client before the competent commercial court until the final decision is issued. In cases of financial reorganization, we work to prepare a reorganization plan in cooperation with certified financial advisors to ensure a balance between the interests of creditors and the debtor in accordance with Article (5) of the Bankruptcy Law, which establishes the principles of transparency and justice.

With our experience in representing small and medium enterprises before the Bankruptcy Committee, we have contributed to saving entities from default and restarting their businesses within regulatory frameworks that preserve reputation and legal interests. This service reflects the role of «Arab Charter» in supporting the Saudi business environment and achieving economic justice through realistic and implementable solutions.

Service delivery steps

- Initial evaluation and financial study

Analyze facts, documents and obligations to determine the most appropriate action. - Determine the systemic path

Choose preventive settlement, financial reorganization, or liquidation, depending on the situation. - File preparation and electronic submission

Drafting the legal and financial report, submitting the application through the Bankruptcy Committee platform, and following it up. - Pleadings and judicial follow-up

Preparing memoranda, representing the client before the commercial court, and communicating with the bankruptcy trustee. - Reorganization and implementation plan

When necessary, prepare a reorganization plan in cooperation with financial advisors and follow up on its adoption and implementation until the final decision.

Why choose this service from us?

- Full commitment to the Saudi bankruptcy system and its executive regulations.

- Legal and financial integration in evaluation, file preparation and plan.

- Legal and financial integration in evaluation, file preparation and plan.

- Integrated judicial representation before the Commercial Court until the decision is issued.

- Realistic, implementable solutions that take into account the balance of interests of creditors and debtors.

- Confidentiality and professionalism according to the highest legal quality standards.

Common questions

This is determined after examining your financial and credit situation; we evaluate options and recommend a path that preserves rights and restores stability.

Basic financial statements, a list of debts and creditors, contracts and obligations, and any documents showing the causes and scope of the default.

We follow up on notifications and correspondence via the platform, communicate with the bankruptcy trustee, and submit the required memoranda until a decision is issued.

Yes, when choosing this procedure, we prepare a reorganization plan in cooperation with certified financial advisors to ensure balance between the parties.

Are you facing a financial downturn and need a systemic path that restores balance? The «Arab Charter» team is ready to accompany you step by step until the decision.